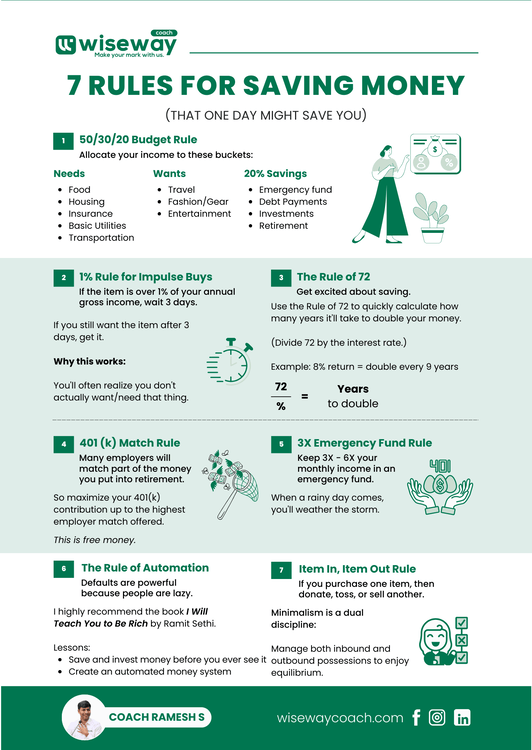

7 Rules for Saving Money

December 28, 2024 2024-12-02 16:097 Rules for Saving Money

7 Rules for Saving Money

Simple Habits for Financial Freedom

Saving money doesn’t have to be complicated. These seven practical rules can help you take control of your finances, prepare for emergencies, and grow your wealth over time.

1. 50/30/20 Budget Rule

Allocate your income into three buckets

50% Needs

Essentials like housing, food, insurance, and transportation.

30% Wants

Non-essentials like travel, entertainment, and shopping.

20% Savings

Build an emergency fund, pay off debts, and invest for the future.

This structure ensures a balanced approach to spending and saving.

2. 1% Rule for Impulse Buys

For big purchases, wait three days if the item costs more than 1% of your annual income.

Often, you’ll find you don’t need or want it after the waiting period.

This simple rule curbs impulsive spending and helps you prioritize.

3. The Rule of 72

Discover how long it takes to double your money with the “Rule of 72”:

Divide 72 by your annual interest rate.

Example: At an 8% return, your investment doubles in 9 years (72 ÷ 8 = 9).

This makes saving exciting by visualizing future growth.

4. 401(k) Match Rule

Many employers match a percentage of your retirement contributions—free money!

Maximize contributions up to the employer’s match limit to grow your retirement savings effortlessly.

5. 3X Emergency Fund Rule

Save 3–6 months of living expenses in an emergency fund.

This safety net helps you weather unexpected expenses like medical bills, job loss, or repairs.

6. The Rule of Automation

Automate your savings and investments so they happen without effort.

Tools and apps can transfer money to your savings or retirement account before you even see it.

As Ramit Sethi explains in I Will Teach You To Be Rich, automation is the key to financial discipline.

7. Item In, Item Out Rule

Adopt a minimalist mindset: for every new purchase, donate, toss, or sell an old item.

This not only saves money but also prevents clutter, encouraging intentional consumption.

Why These Ratios Matter

These strategies simplify money management, encourage thoughtful spending, and emphasize building financial security. Whether you’re saving for retirement, an emergency, or your next big goal, these habits make the journey easier.

"Financial freedom isn’t about how much you earn, but how wisely you save and invest."

– Coach Ramesh S

For More Details

Ready to elevate your business? Our tailored coaching programs help entrepreneurs unlock their potential and achieve sustainable growth. Start with a free strategy session to discover your roadmap to success!