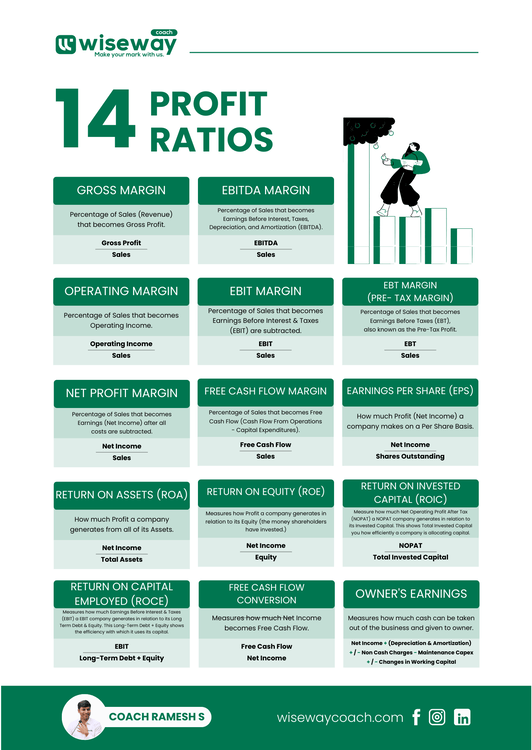

14 Essential Profitability Ratios to Measure Business Success

July 4, 2024 2024-11-22 14:5414 Essential Profitability Ratios to Measure Business Success

14 Essential Profitability Ratios to Measure Business Success

Profitability ratios are key financial metrics that help evaluate a company’s ability to generate profit relative to its revenue, assets, equity, and capital. Here’s a breakdown of 14 profit ratios every business should know to assess financial health and performance:

1. Gross Margin

Formula

Gross Profit / Sales

Indicates the percentage of revenue that remains after covering the cost of goods sold (COGS).

2. EBITDA Margin

Formula

EBITDA / Sales

Shows the percentage of sales that translates into Earnings Before Interest, Taxes, Depreciation, and Amortization (EBITDA).

3. Operating Margin

Formula

Operating Income / Sales

Reflects the percentage of sales that becomes operating income after covering operating expenses.

4. EBIT Margin

Formula

EBIT / Sales

Measures the percentage of revenue that translates into Earnings Before Interest and Taxes (EBIT).

5. EBT Margin (Pre-Tax Margin)

Formula

EBT / Sales

Indicates the percentage of sales that turns into earnings before taxes, providing insight into pre-tax profitability.

6. Net Profit Margin

Formula

Net Income / Sales

Reveals the percentage of revenue that becomes net income after all expenses, taxes, and costs are deducted.

7. Free Cash Flow Margin

Formula

Free Cash Flow / Sales

Represents the percentage of sales that converts into free cash flow, considering cash flow from operations minus capital expenditures.

8. Earnings Per Share (EPS)

Formula

Net Income / Shares Outstanding

Shows the profit available per outstanding share, useful for investors assessing earnings.

9. Return on Assets (ROA)

Formula

Net Income / Equity

Measures how effectively a company uses its assets to generate profit.

10. Return on Equity (ROE)

Formula

Net Income / Equity

Indicates the profit generated relative to shareholders' equity, reflecting the company’s efficiency in generating returns.

11. Return on Invested Capital (ROIC)

Formula

NOPAT / Total Invested Capital

Assesses how effectively a company uses its invested capital to generate profit.

12. Return on Capital Employed (ROCE)

Formula

EBIT / (Long-Term Debt + Equity)

13. Free Cash Flow Conversion

Formula

Free Cash Flow / Net Income

Measures how much net income translates into free cash flow, indicating cash efficiency.

14. Owner’s Earnings

Formula

Net Income + (Depreciation & Amortization) - Non-Cash Charges - Maintenance Capex + Change in Working Capital

Highlights the cash available for business owners to withdraw or reinvest, providing insight into cash flow sustainability.

Why These Ratios Matter

Profitability ratios give a comprehensive view of a company’s financial health, operational efficiency, and ability to generate returns. By monitoring these metrics, businesses can make informed decisions to enhance growth and profitability.

Measuring profitability isn’t just about numbers; it’s about understanding what drives success and planning for sustainable growth.

– Coach Ramesh S

For More Details

Ready to elevate your business? Our tailored coaching programs help entrepreneurs unlock their potential and achieve sustainable growth. Start with a free strategy session to discover your roadmap to success!