Financial Statement

July 4, 2024 2024-11-22 15:15Financial Statement

Financial Statement A Beginner's Guide to Understanding Business Finances

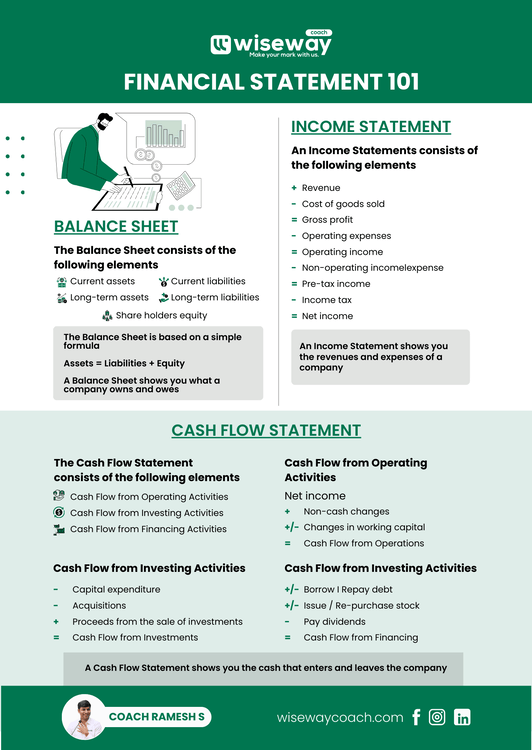

Financial statements are the cornerstone of understanding a company’s financial health. They provide insights into what a company owns, earns, and spends. This guide breaks down the three key financial statements: the Balance Sheet, Income Statement, and Cash Flow Statement.

1. Balance Sheet

The Balance Sheet provides a snapshot of a company’s financial position by showing what it owns (assets) and owes (liabilities and equity).

Key Elements

Current Assets:

Cash, accounts receivable, inventory.

Long-Term Assets

Property, equipment, and intangible assets.

Current Liabilities

Short-term obligations like accounts payable and accrued expenses.

Long-Term Liabilities

Long-term debts and obligations.

Shareholders' Equity

Owner’s stake in the company after liabilities are subtracted from assets.

Formula: Assets = Liabilities + Equity

The Balance Sheet answers: What does the company own, and how is it financed?

2. Income Statement

The Income Statement details the company’s revenues, costs, and profits over a period of time, providing insights into profitability.

Key Elements

Revenue

Total sales income.

Cost of Goods Sold (COGS)

Direct costs of producing goods/services.

Gross Profit

Revenue - COGS.

Operating Expenses

Administrative and selling costs.

Operating Income

Gross profit - Operating expenses.

Non-Operating Income/Expenses

Income or costs unrelated to core operations.

Pre-Tax Income

Operating income +/- non-operating income/expenses.

Net Income

Pre-tax income - Income taxes.

The Income Statement answers: How much revenue does the company generate, and is it profitable?

3. Cash Flow Statement

The Cash Flow Statement tracks the cash coming in and going out, providing a real-time picture of liquidity.

Key Elements

Cash Flow from Operating Activities

Net income adjusted for non-cash changes (e.g., depreciation) and changes in working capital.

Cash Flow from Investing Activities

Cash spent on capital expenditures or received from selling investments.

Cash Flow from Financing Activities

Borrowing, repaying debt, issuing/re-purchasing stock, and paying dividends.

The Cash Flow Statement answers: How is cash flowing in and out of the business, and is it sustainable?

Why Financial Statements Matter

Understanding these statements enables business owners and stakeholders to

- Assess profitability and efficiency.

- Identify financial risks and opportunities.

- Make data-driven decisions to drive growth.

Financial literacy isn’t optional—it’s the foundation of sustainable success.

– Coach Ramesh S

For More Details

Ready to elevate your business? Our tailored coaching programs help entrepreneurs unlock their potential and achieve sustainable growth. Start with a free strategy session to discover your roadmap to success!